Authors

A. Faye Borthick

Abstract

Despite effective development practices and sound validation procedures, spreadsheet errors may persist. A spreadsheet is only as good as its model logic and the correctness of its application.

Because it is not possible to prove that computer programs, including spreadsheets, do what they are supposed to do and nothing else, auditors must always be ready to recognize symptoms of erroneous results and investigate accordingly.

Applying validation procedures will, however, decrease the likelihood of obtaining and relying on erroneous spreadsheet results.

Sample

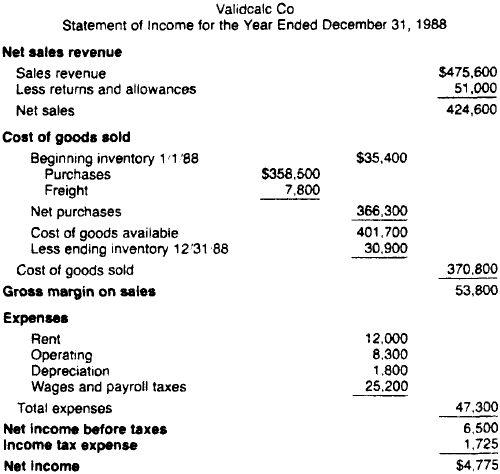

Perturbing a value can reveal an error. In this case, $1,000 was added to the formula for ending inventory in the year-end worksheet. All subsequent values on the income statement through net income before taxes changed, but income tax expense did not.

The failure of income tax expense to change indicates an error in the income tax expense calculation, occurring in either the year-end worksheet or the income statement.

When the errors have been corrected, income tax expense values would move consistently with changes in ending inventory.

Publication

1989, EDPACS: The EDP Audit, Control, and Security Newsletter, Volume 17, number 3, September, pages 1-8

Full article

Not available