Authors

Frances Moreno & Szilvia Juhasz

Abstract

Most financial professionals understand the potential consequences of spreadsheet errors, but the horror stories continue to pile up. For example: One company saw its stock fall by 15 percent when, following its report of a 3 percent rise in revenue, it turned out that revenue fell 5 percent. The error occurred when data was transferred from an accounting system to a spreadsheet used to produce trading statements.

Another corporation had to halt trading on its stock after details of its almost $3 billion profit were embedded in a template of the previous year’s results and became widely accessible. It turned out that someone thought a black cell background fill would hide the text. It did not.

A major corporation almost gave an employee an $11 million severance package due to a faulty spreadsheet with too many zeros. And another company lost 25 percent of its value after inaccurately reporting its fourth quarter earnings due to a misrecorded number in one cell of a spreadsheet.

Fortunately, there are methods that CPAs can use to avoid these types of problems that lead to financial loss and embarrassment — and avoid the nightmares. These methods require only incorporating some practical tips for building a better spreadsheet model.

Sample

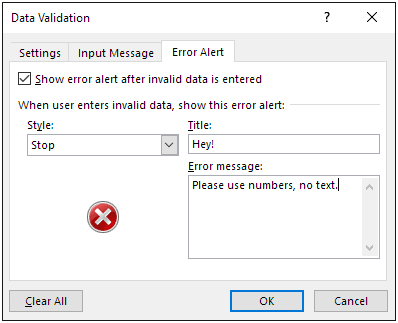

Data validation techniques can help prevent mistakes by setting input rules that can be applied to specific cells or ranges, along with real-time pop-up messages to guide the end user.

Publication

2011, Technology & Business Resource Guide

Full article

To err or not - consequences of spreadsheet errors and how to avoid them